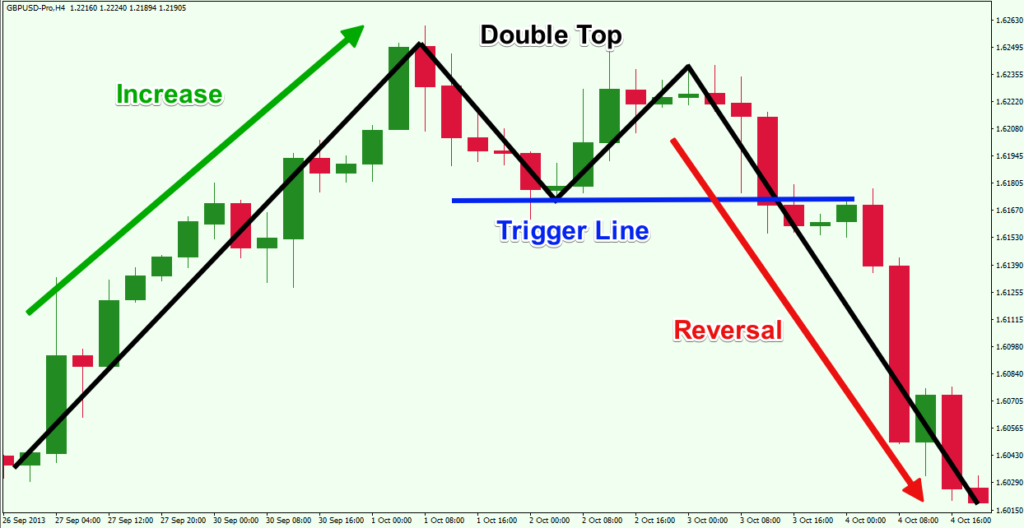

Have a look at the following example: Double tops can enhance technical analysis when trading both forex or stocks.

Top Forex Reversal Patterns that Every Trader Should Know

Top Forex Reversal Patterns that Every Trader Should Know

It consists of 2 tops at nearly the same level with a valley in between, which creates the neckline.

Double top trading. The trading rule for the double bottom pattern is similar to the double top pattern, the only difference is that we were taking a short position is double top, whereas we are looking for a long trade setup in the double bottom pattern. ( amzn ) and shows a double top pattern that formed in the stock between september. The double top reversal is composed of two consecutive peaks with approximately the same highs.

Let’s learn how to identify these chart patterns and trade them. And the indication of that is the word top. A double top is a bearish reversal trading pattern.

We’re looking for the top, we are looking for the end of a trend. The double top pattern is a bearish reversal trading pattern that emerges at the end of a bullish trend. So this is not a trend.

It is made up of two peaks above a support level, known as the neckline. How to short the highs of the double top. At this point, many traders will look to long the breakout.

Double top patterns are noteworthy technical trading structures to learn and integrate into a trader’s arsenal. The chart above is of amazon.com inc. This is what gives it the m shape.

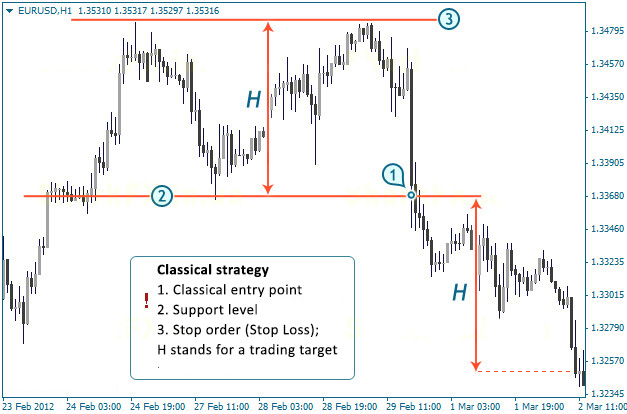

There's a very simple trading technique or strategy that you can use to short the highs of double top. Now that we have discussed the steps for trading the double top, we will shift our attention to an actual price chart which has a double top formation. Instead, the price finds resistance at a previous swing high and reverses, forming two highs at roughly the same price level (hence the name, double top.) a double top pattern is shown in the following eur/usd chart.

A double top pattern without the close below the neckline is not technically a double top. The first peak will come immediately after a strong bullish trend, and it will retrace to the neckline. Volume is coming in even though price is falling.

Let’s take a look at an example featuring a double top (m signal). As price nears support, which is the trough, it needs to break and fall below that for the double top reversal to be complete. It's a reliable reversal pattern that can be used to enter a bearish position after a bullish trend.

Double top and double bottom are opposite to each other in terms of their characteristic. The double top reversal is a bearish reversal pattern typically found on bar charts, line charts, and candlestick charts. The red horizontal line on the bottom between the two tops is the signal line.

A double top trading strategy that takes advantage of “trapped” traders. The double top is one of the most popular patterns in trading. After a decent price increase, google creates a top.

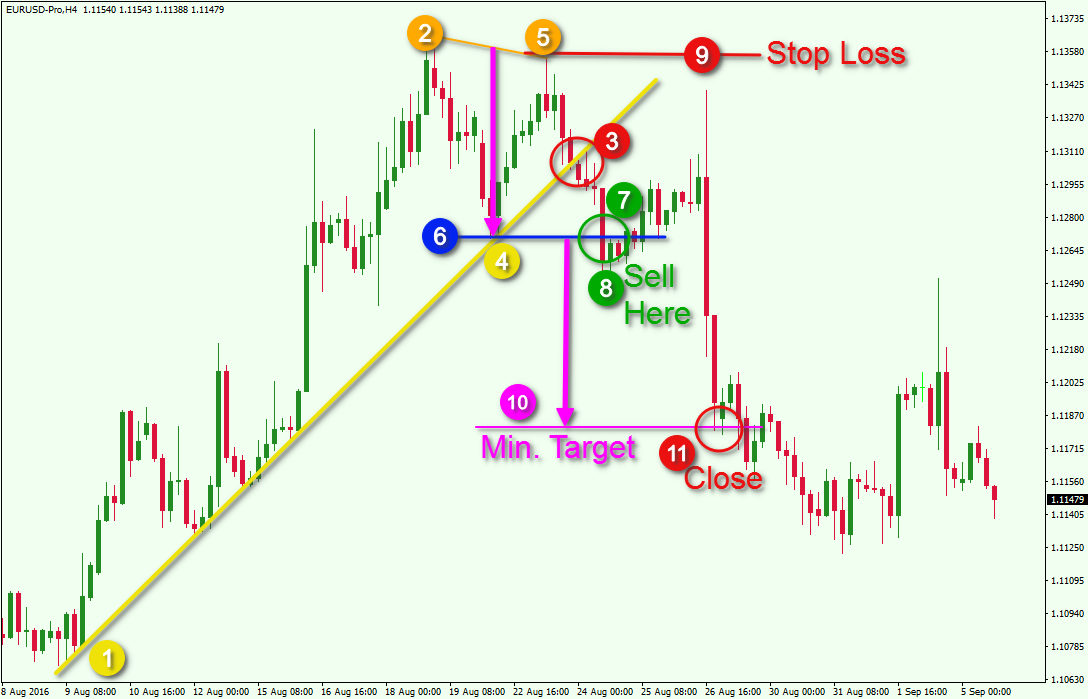

You don't want to just simply place a sell limit on there and think that the market will form a double top. That’s really the point of this pattern. The image covers the period during august 2016 and shows.

Once it hits this level, the momentum will shift to bullish once again to form the second peak. Just look at how bullish the candle is! Both the double top and triple top are toppings patterns, so when the pattern completes consider exiting long positions and focus on taking short positions.

On the rsi it's possible we've seen a double top and an h&s may be on the verge of forming; A double top is a reversal pattern that is formed after there is an extended move up. Trading double and triple tops.

Let's say that the market is again in an uptrend, comes down, then retest back towards the high. To go short, you have to first identify the neckline of the double top like the diagram below: It appears as though buzz is trading in a micro bullish flag outlined in light green inside of a macro ascending triangle in dark blue.

Then there is a corrective move followed by a new price increase which develops into a second top. When a double top or double bottom chart pattern appears, a trend reversal has begun. You need volume for this as well.

Allow me to explain… i hear many traders calling two tops near an important level a double top all of the time. A double top pattern usually forms at the top of an uptrend with the price failing to form a fresh higher high. To profit from a double top, a trader must take a short position on the security, which means selling the asset at a higher price to buy it back in the future at a lower price.

Double top (failed breakout) this example shows a failed breakout that ended as a double top pattern. However, unless the neckline has been broken, they are mistaken. This is how technical analysts trade the double top and is the most standard way of trading it.

A la validation de la figure en double top (cassure de la ligne de cou), il est fréquent que le cours effectue un pullback en résistance sur la ligne de cou avant d'atteindre l'objectif de la figure. Double top and bottom trading example. Look at the chart below:

The uptrend is now over and a downtrend is likely underway. No chart pattern is more common in trading than the double bottom or double top.in fact, this pattern appears so often that it alone may serve as proof positive that price action is not as wildly. As mentioned, once you confirm the double top, revert to the candlestick chart for closer analysis.

The “tops” are peaks which are formed when the price hits a certain level that can’t be. Cara trading menggunakan pola double top: If so the bullish flag will be negated thus resulting in a descending triangle.

You can see in the diagram above that the neckline is drawn across the “trough” between the two tops. What they think is a reversal pattern could just be consolidation. When trading double top patterns you need a decline in price from the second peak.

A double top is a bearish indicator, which means that it intends to predict a potential drop in the price of a security. The reason is, the first thing you need to get a stock market double top trading chart pattern is you’ve got to have a trend.

Follow these 7 tips to look for high probability trade setups

forexchartpatterntradingondoublebottom ForexTrading

forexchartpatterntradingondoublebottom ForexTrading

Double Top and Double Bottom formations

Double Top Formation Trading Secrets Revealed Fxklex

Double Top Formation Trading Secrets Revealed Fxklex

Double Top Chart Patterns Free Stock Market… Stock

Double Top Chart Patterns Free Stock Market… Stock

Stock Market Double Top Trading Chart Pattern YouTube

Stock Market Double Top Trading Chart Pattern YouTube

“Double top” and “Double bottom” patterns in Forex FXSSI

“Double top” and “Double bottom” patterns in Forex FXSSI

10 Chart Patterns For Price Action Trading

10 Chart Patterns For Price Action Trading

Double Top Pattern Technical Patterns Forex Trading

Double Top Pattern Technical Patterns Forex Trading

double top example ForexTheBasics ForexBasics Trading

double top example ForexTheBasics ForexBasics Trading

The Simple Double Top Pattern Naked Trading Explained

The Simple Double Top Pattern Naked Trading Explained

How To Trade Double Top and Double Bottom Patterns

How To Trade Double Top and Double Bottom Patterns

The Best Forex Trading Strategies of 2019 FoxyTrades

How to Trade Double Top Pattern Your Complete Guide to

How to Trade Double Top Pattern Your Complete Guide to

How to Trade With Double Top and Double Bottom Price

How to Trade With Double Top and Double Bottom Price

forexchartpatterntradingondoubletop LearnForex

forexchartpatterntradingondoubletop LearnForex

Double Top and Double Bottom formations

Double Bottom Trading Pattern Estradinglife Estradinglife

Double Bottom Trading Pattern Estradinglife Estradinglife

Pure Price Action Presentation 6 Double Top & Double

Pure Price Action Presentation 6 Double Top & Double

0 Comments