If you want to master pinpointing key intraday support and resistance levels, precision entry, and exit point the camarilla trading strategy can help you achieve those goals. A widely popular indicator that comes inbuilt in most.

How to Apply Pivot Points Effectively when Trading Forex

How to Apply Pivot Points Effectively when Trading Forex

The strategy works pretty good for crypto, 30m, 1h, 2h timeframes.

Pivot trading strategy. The pivot point strategy refers to taking bounce trades off of the pivot point. Trading the bounce (reversal) from pivot. We check rsi level at the pivot point level and only if rsi condition is satisfied we update levels for stop orders.

This as the name suggests is a intraday trading system using pivot points. If you have a good idea of the general direction of the market, you can take bounce trades off the pivot point in the direction of where the market was relative to pp at open of day. You’ll find pivot points adapted to every kind of strategy:

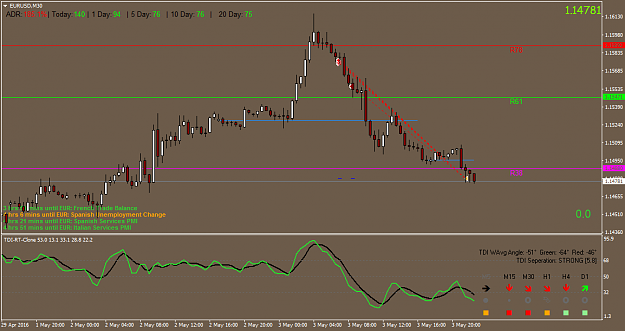

Weekly pivot bounce forex trading strategy is a combination of metatrader 4 (mt4) indicator(s) and template. Pivot points are often used for day trading and market making and they are denoted with support and resistance levels that favor the trend an asset is moving in. Pivot points are price levels calculated using the high, low, and close of the last trading session.

Using pivot points in forex trading. The pivot point points in the direction of where the asset wants to be heading next. As you see, the price increases rapidly afterwards.

This page will just help you to filter out scrips that can be used for selling and buying in intraday. This was a nice simple way for floor traders to have some idea of where the market was heading during the course of the day with only a few simple calculations. We have few types of pivot points:

The camarilla pivot trading strategy is a better way to use pivot points to improve your trading. Trading the bounce from pivot; Forex trading strategy & education.

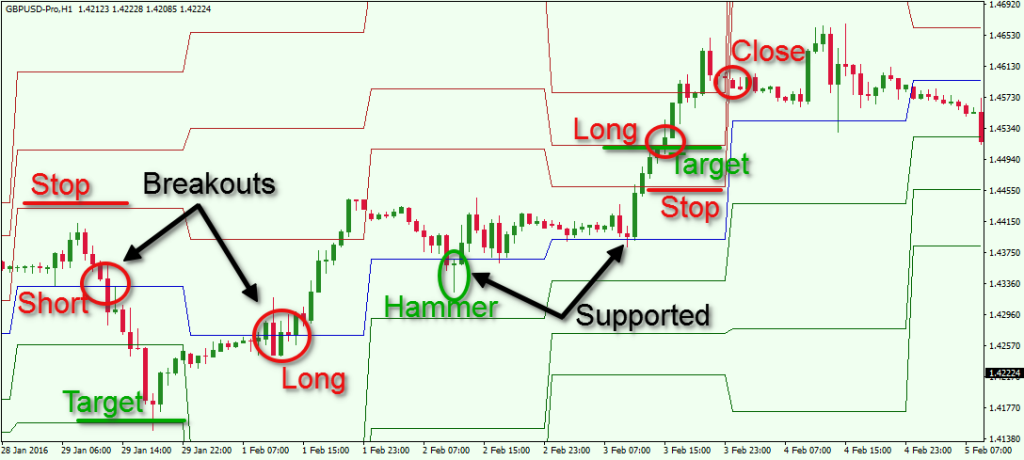

As with all my strategy videos, i walk you through step by step: 1) the setup 2) entry 3) take profit targets 4) stop loss placement 5) lots of examples indicators needed are emas and a pivot point indicator. It will take away the subjectivity involved with manually plotting support and resistance levels.

Indicators used in this system will be same as our pivot points intraday strategy. This way, you have practically decided to adopt the “ride the trend” strategy. You need to learn how to trade with pivot points the right way.

Taking trades at these levels in the direction of the expected reversal is a very common technical strategy. Trading the break of pivot; Here, we will share two basic pivot points trading strategies to further advance your forex trading arsenal.

The essence of this forex system is to transform the accumulated history data and trading signals. This is a day trading trend strategy that identifies an established trend, and waits for a pull back to the daily pivot. In trading stocks and other assets, pivot points are support and resistance levels that are calculated using the open, high, low, and close of the previous trading day.

So daily pivot points are […] Gauging the strength of a market move with the acd system. You can also use pivot points and the various support and resistance levels calculated from them for trend trading.

Now that you have seen the different ways other traders use pivot points in trading, it is fine to consider how you can develop a good trading strategy using the indicator. Candlestick trading strategies) trading tools pivot points. John person’s candlestick trading approach uses pivot points for confirmation.

This makes our trading system very similar to day trading except the fact that our day lasts for the entire week. However, they can also be used in swing trading or long term trading. Pivot points drawn weekly can be used for a very good swing trading strategy.

Pivot point forex trading strategies. Just a point to note that, this system. At this point, it should seem fairly straightforward that pivot points are used as prospective turning points in the market.

Pivot point breakout strategy many traders attempt to focus their trading activity to the more volatile periods in the market when the potential for large moves may be elevated. In this review, we are using a simpler version of his trading strategy. In order to be profitable when trading with pivot points, you first need to determine the main trend , or at least the main trend on the smaller timeframes.

In addition to breakouts and range trading, traders use other pivot point trading strategies. Pivot point trend trading strategy. Thanks to them, you are trading with tools used on trading floors.

Most often, pivot points are used in day trading simply because they work so good. Trading the bounce from support / resistance (r2/s2) strategy #1: This strategy joins the pivot reversal strategy with the rsi indicator.

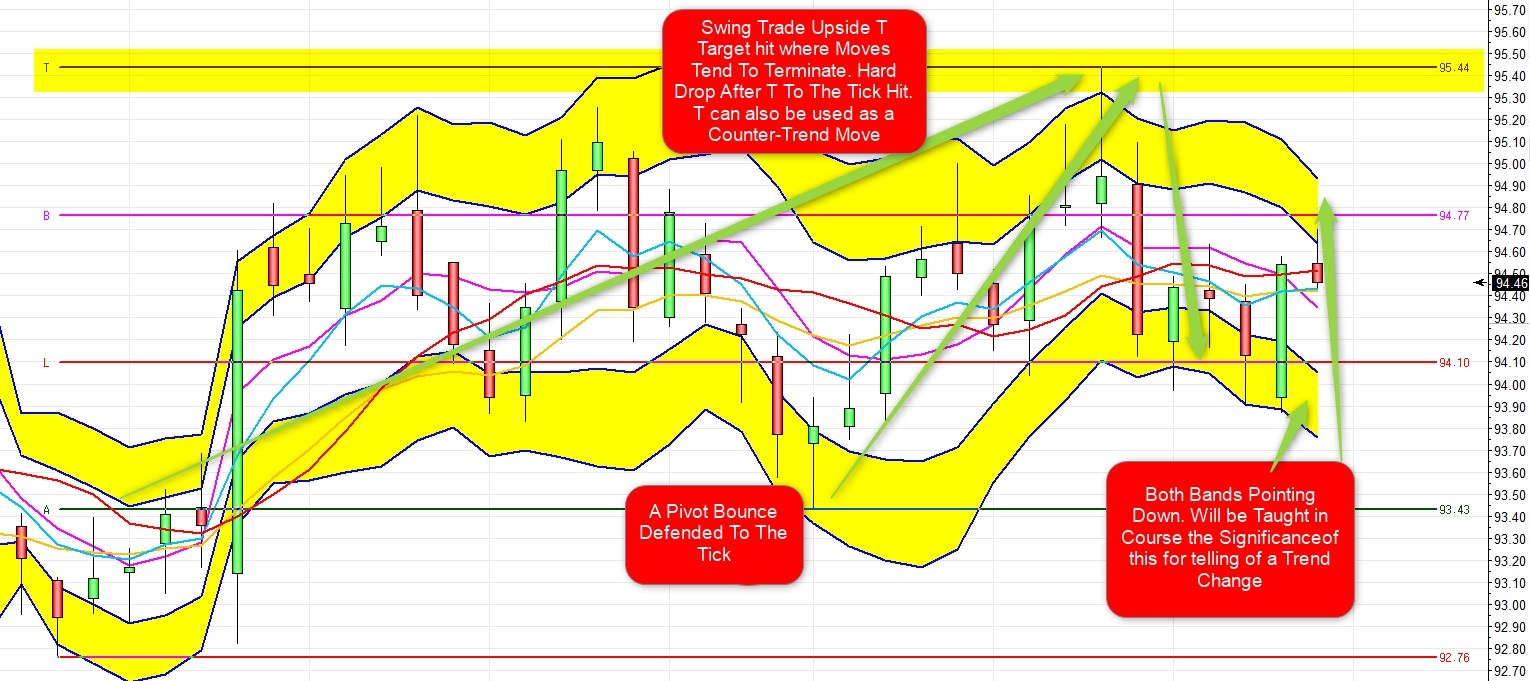

The image illustrates bullish trades taken based on our pivot point breakout trading strategy. If you want to take full advantage of the power behind the pivot points. How to trade with pivot points the right way.

The idea is to take advantage of retracements at significant levels after price has chosen a direction based on the pivot point. Pivot point intraday trading strategy [breakout]: You can apply any calculator to find buy or sell levels.

Trading with pivot points is the ultimate support and resistance strategy. Best pivot points trading strategy for scalping/day trading scalping and day trading with the pivot points is a good choice for the traders that enjoy lower timeframes. Oscillator trendanalysis volumestudies pivot profit reversal reversalpattern strategy perfection excellent.

This is your all in one guide to what is camarilla pivot point. Rameshsmn1 oscillators trend analysis volume pivot profit reversal reversalpattern strategy perfection excellent. Pivot point trading you are going to love this lesson.

In this post we will show you a totally mechanical system based approach to trade pivot points. Formulating a trading strategy with pivot points. The strategy says that if open=high, one should go short in that scrip and when open=low, one should go long in that scrip.

We go long and we place a stop loss order below the previous bottom below the r1 pivot point. Using pivot points as a trading strategy has been around for a long time and was originally used by floor traders. Pivot points are one of the more popular indicators when it comes to intraday trading.

You can build very good strategy around pivot points. The first trade is highlighted in the first red circle on the chart when bac breaks the r1 level. Ticker trading ideas educational ideas scripts people.

The pivot point bounce is a trading strategy or system that uses short timeframes and the daily pivot points. Daily weekly monthly and others, based on time frame lines comes from mathematic formula which is based on data from previous period.

A detailed overview of Pivot Trading Pro’s forex strategy

A detailed overview of Pivot Trading Pro’s forex strategy

Stock Trading Pivot Point Courses Strategy for Beginners

Stock Trading Pivot Point Courses Strategy for Beginners

Simple Pivot Points Trading System Learn Forex Trading

Simple Pivot Points Trading System Learn Forex Trading

Forex Pivot Point Strategy based on Price Action YouTube

Forex Pivot Point Strategy based on Price Action YouTube

Pivot points trading strategy, how to use pivot points

Pivot points trading strategy, how to use pivot points

Pivots Strategy Looking For More Than A R2 or S2 Level

Pivots Strategy Looking For More Than A R2 or S2 Level

Advanced pivot point trading strategy in the 5minute

Candlestick and Pivot Point Day Trading Strategy Trading

Forex pivot point strategy pdf

Pivot Point High Accuracy Trading Strategy Forex Trading

Pivot Point High Accuracy Trading Strategy Forex Trading

Comparing the Different Types of Pivot Points Forex

Comparing the Different Types of Pivot Points Forex

best trading strategy 'pivot point forex webinar YouTube

best trading strategy 'pivot point forex webinar YouTube

How to Apply Pivot Points Effectively when Trading Forex

How to Apply Pivot Points Effectively when Trading Forex

Simple Pivot Points Trading System Learn Forex Trading

Simple Pivot Points Trading System Learn Forex Trading

How to Apply Pivot Points Effectively when Trading Forex

How to Apply Pivot Points Effectively when Trading Forex

What Are Pivot Points & How To Trade With Them Honest

What Are Pivot Points & How To Trade With Them Honest

Pivots Trading Strategy How A Long Trade Works — Forex

Pivots Trading Strategy How A Long Trade Works — Forex

DB Pivots Trading System Trend Following System

DB Pivots Trading System Trend Following System

What Are Pivot Points & How To Trade With Them Honest

What Are Pivot Points & How To Trade With Them Honest

0 Comments