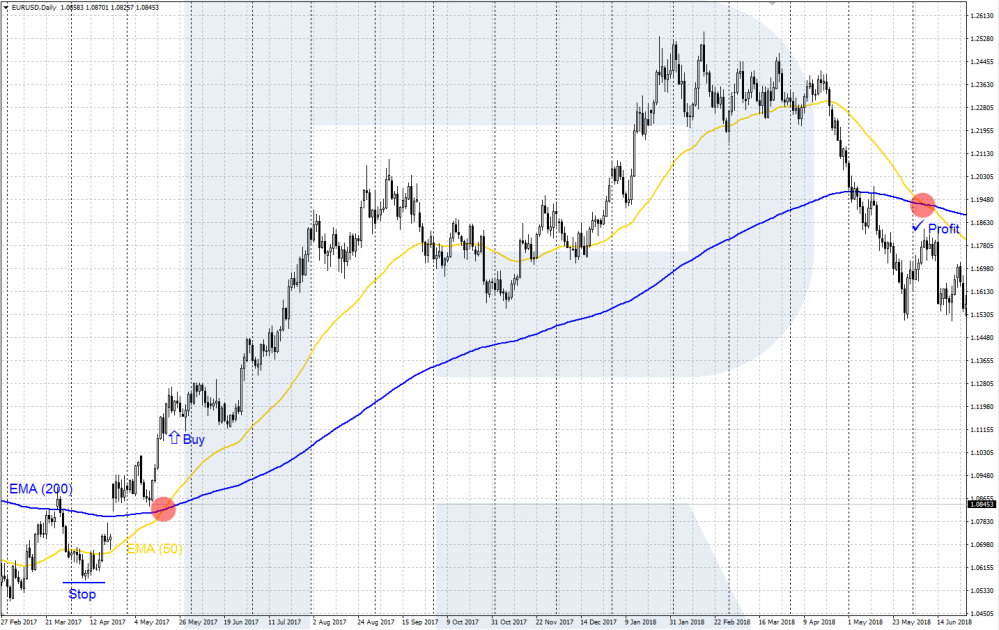

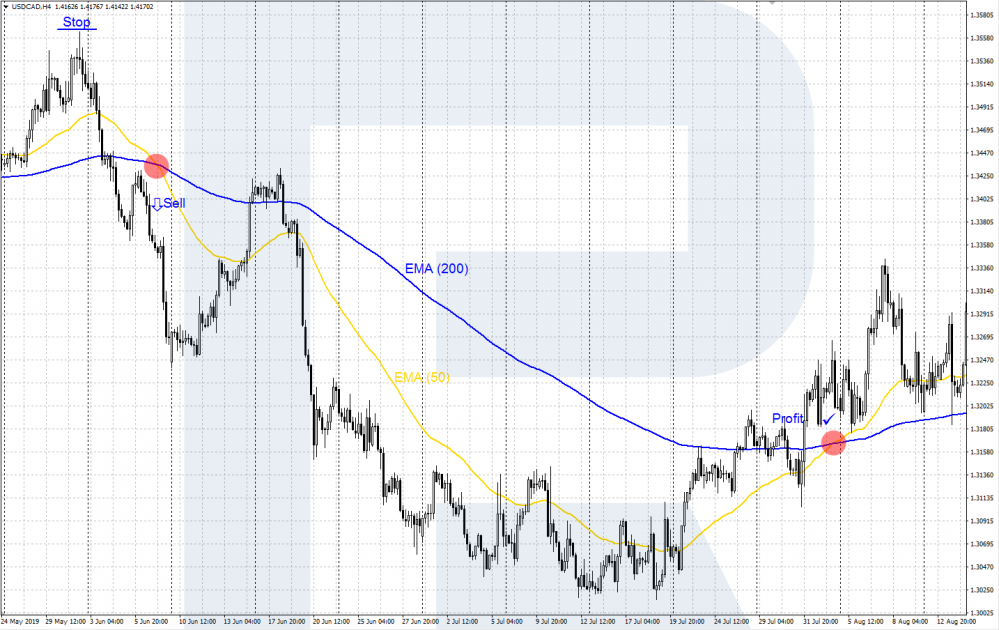

Designed for swing trading purposes, it calculates two moving averages of the close price and adds simulated orders based on their crossovers. When the ema 50 crosses below the ema 200 the strategy indicates a sell.

Forex Wealth 10 Roads to Riches How to Crush the

Forex Wealth 10 Roads to Riches How to Crush the

When the ema 50 crosses over the ema 200 the strategy indicates a buy.

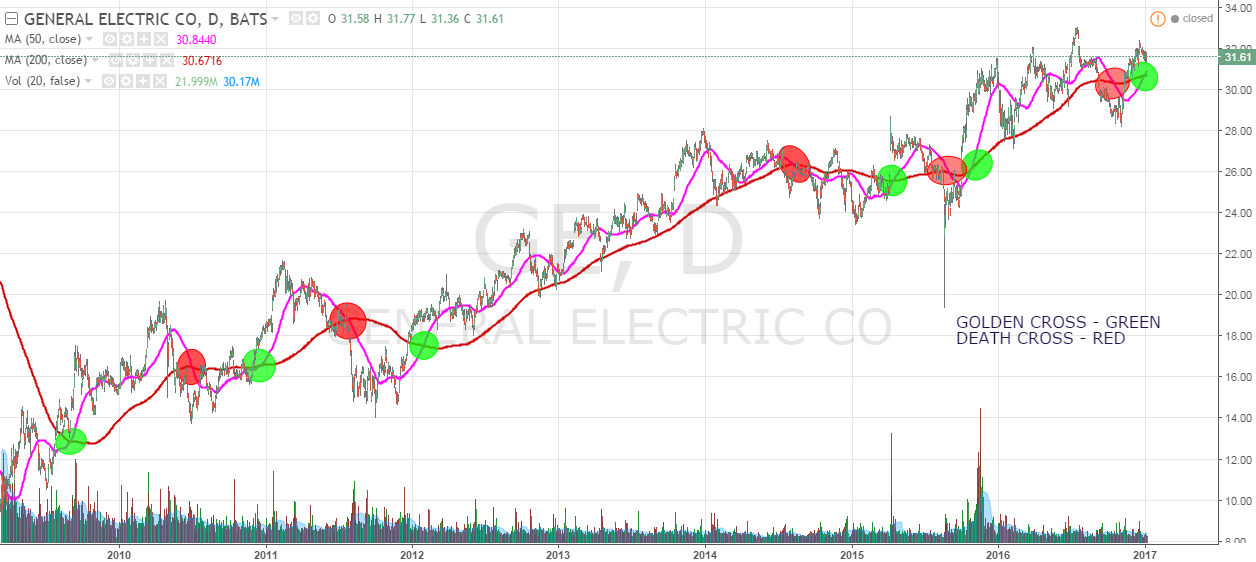

Golden cross trading strategy. The golden cross and death cross. A golden cross recently happened in the dow jones. We often hear references of the death cross.

Two very famous technical patterns that fall under the category of swing trading strategies include the “golden cross” and “death cross”. This python snippet can be used to test trading strategies using the golden cross and the death cross. Now, you don’t want to go long.

Golden cross & death cross. A golden cross is an important trading strategy that uses a combination of longer and shorter moving averages. This information has been prepared by ig, a trading name of ig markets limited.

A golden cross means that the instrument that it occurs on is now in bullish mode and most traders will look for long trading positions in those markets. But if after 30 losses, the trading account. The death cross is the opposite.

The death cross strategy will help you take control of your trading and help you predict with deadly accuracy when the stock market crash will happen. Price action trading tips for using the golden cross. However, it is not uncommon for the market to stay in the meandering phase for a prolonged period.

Suggestions for swing trading the golden cross and death cross speed is key. The three stages of a golden cross. Download a free spreadsheet with data, charts.

Clearly, the golden cross has a positive bias, and the market is likely to head higher after it occurs. The golden cross happens when the 50 day simple moving average crosses over the 200 day simple moving average crossover and stays above until the end of the day. This is the most popular and famous bullish moving average crossover entry signal along with its inverse ‘death cross’ bearish exit or short selling signal.

Even better, the second golden cross pays off as the foreign exchange rate rises to top off at a high of 1.4889 (over 100 pips above the support level). That said, back testing a golden cross trading strategy upon various asset classes can drive interesting results and one might just find this more applicable as a technical analysis tool. This is a simple trading strategy that seeks the golden cross and death cross on the 4hr chart.

The golden cross is a reversal and breakout signal, which is why there must exist a falling trend to begin with. Like all trading strategies, it has its challenges. This simple strategy demonstrates the use of pine script version 4 label feature to show status box.

A lot of traders use what is commonly known as the golden and death cross in their trading. How to better time your entry using this one simple technique. That is, with high trading volumes and higher trading prices, the golden cross is possibly a sign that the stock market is poised for recovery.

30 losing trades in a row obviously mean something is seriously wrong with the trading strategy. The first stage involves a long term downtrend, the long term moving average must be falling. We will divide the golden cross into three steps to make the concept more clear:

And in the next section, you’ll learn how to better time your entry when trading the golden cross. In addition to the disclaimer. Simple vs exponential moving average crossover

The fast moving indicator in this strategy is the ema 50 and the slow moving indicator is the ema 200. Only those stocks that show golden cross should be bought for accumulating portfolio. This is seen as bullish.

It is because when the stock market goes through ups and downs, it creates a whipsaw effect in the short. The golden cross is a very popular trading concept used for generating trading signals. The name of this strategy refers to the popular golden cross breakout pattern, an event where.

The golden cross refers to when the 50 period moving average breaks through and above the 200 period moving average. It renders the box in green if profit is positive, red if negative and blue if neutral. Read on… golden cross trading strategy:

Michael stokes over at marketsci has also written a great series on trading the golden cross. This box can display anything, in this case it shows current market position, current profit and close price. And results for all 1750 moving average crossovers tested.

Is Trading the Golden Cross Profitable? The Trade Risk

Is Trading the Golden Cross Profitable? The Trade Risk

The Golden Cross and the Dead Cross Can Suck Big Time

The Golden Cross and the Dead Cross Can Suck Big Time

Understanding Golden Cross And Death Cross Properly

Understanding Golden Cross And Death Cross Properly

The Golden Cross Moving Average Strategy For Price Action

The Golden Cross Moving Average Strategy For Price Action

Top 3 Simple Moving Average Trading Strategies

Top 3 Simple Moving Average Trading Strategies

Golden Cross Forex Scalper Le Forex

Golden Cross Forex Scalper Le Forex

The Complete Golden Cross Trading Strategy Guide COLIBRI

The Complete Golden Cross Trading Strategy Guide COLIBRI

Trading With the Golden Cross Strategy R Blog RoboForex

Trading With the Golden Cross Strategy R Blog RoboForex

The Golden Cross Moving Average Strategy For Price Action

The Golden Cross Moving Average Strategy For Price Action

Top 3 Simple Moving Average Trading Strategies

Top 3 Simple Moving Average Trading Strategies

Trading With the Golden Cross Strategy R Blog RoboForex

Trading With the Golden Cross Strategy R Blog RoboForex

The Golden Cross Moving Average Strategy For Price Action

The Golden Cross Moving Average Strategy For Price Action

Top 3 Simple Moving Average Trading Strategies

Top 3 Simple Moving Average Trading Strategies

The Golden Cross Moving Average Strategy For Price Action

The Golden Cross Moving Average Strategy For Price Action

The Golden Cross Moving Average Strategy For Price Action

The Golden Cross Moving Average Strategy For Price Action

6 Tips for How to Use the 50Day Moving Average

6 Tips for How to Use the 50Day Moving Average

0 Comments