The trader and the broker agree between themselves to replicate market conditions and settle the difference amongst themselves when the position closes. Cfd trading is a method that enables individuals to trade and invest in an asset by engaging in a contract between themselves and a broker, instead of acquiring the asset directly.

Learn more about cfd trading img source:

What is cfd trading. That means that instead of trading an asset directly, you trade a contract that is based on the value of that asset. Apabila pasar sedang anjlok atau salah satu aset kalian tengah mengalami penurunan harga, maka hal itu akan berpengaruh secara negatif terhadap investasi kalian secara keseluruhan. The concerns over the leveraged otc product combined with the increased regulatory scrutiny following the 2008 financial crisis, have resulted in the sec taking a dim view of cfd products.

To save you from all those common mistakes you can make as a beginner, i decided to write this guide and tell you about all the trading tips and strategies you need to know about. A contract for difference (cfd) is a popular form of derivative trading. An option in stock market parlance is essentially an agreement that gives a trader a right to buy or trade an asset at a certain price in the future regardless of the price at that point.

On 6 th january 2021, it became illegal for a broker conducting business in the u.k. Today, there is so much information regarding cfd trading, even a beginner could make some real cash out of it. Cfds are a derivative product because they enable you to speculate on financial markets such as shares, forex, indices and commodities without having to take ownership of the underlying assets.

Trading cfds is becoming increasing popular among traders, and is a widely offered type of trading among all of the top online brokers. Cfd trading is defined as ‘the buying and selling of cfds’, with ‘cfd’ meaning ‘contract for difference’. When you trade in cfds, you will directly notice that the transaction costs are always relative to the investment you make.

This is a particular type of derivative offered by brokers whereby you are trading on the […] A contract for difference (cfd) is a popular form of derivative trading. So, what exactly is cfd trading?

Cfd trading is the activity of trading contracts for difference with a broker. A contract for differences (cfd) is an agreement between an investor and a cfd broker to exchange the difference in the value of a financial product between the time the contract opens and closes. While buying and selling actual bitcoins and other cryptocurrencies remains perfectly legal, as very few brokers offer this service and instead allow clients to trade cfds based upon the market prices of cryptocurrencies, trading in.

When trading cfd, it is necessary to know the financial derivative instrument to be able to trade with a higher probability of success. When you trade cfds you are entering into an agreement to exchange the difference in the price of an asset from the point at which the contract is opened to when it is closed. The costs are referred to as spread, which is the difference between the purchase and selling price.

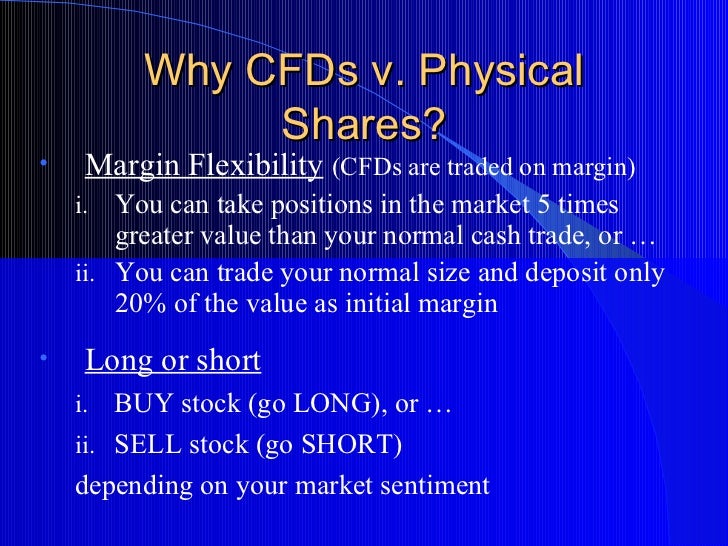

A contract for difference (cfd) is a popular type of derivative that allows you to trade on margin, providing you with greater exposure to the financial markets. Cfds (contract for difference) are derivative products, in which you can trade on the difference between a certain asset’s set starting value and its closing value. Cfd stands for contract for difference.

Cfds are a type of derivative, meaning you do not buy the underlying asset itself. A financial instrument is a contract by which we trade in a market for example bond, share, bill of exchange, futures or options contract, cheques, currency swap, drafts, or more. Cfd trading is the buying and selling of contracts for difference via an online provider.

For example, instead of buying and selling shares outright, you instead buy and sell a contract whose value depends on the price of the underlying shares. Cfd trading is banned and illegal for citizens from the usa. For instance, a trader with an option for a.

Trading di pasar finansial global terpopuler di dunia: Cfd trading is not like this because neither party actually owns a piece of the asset in question. Cfd forex, indeks, komoditas, saham, dan kripto dengan spread mulai 0 pip.

Cfds are considered derivative products and allow people to speculate on markets such as forex, commodities, shares and indices without actually buying or selling any of the assets. The term cfd stands for contract for difference which are a type of trading instrument and a popular gateway for investors to enter the financial markets. They are offered by brokers alongside other types of common assets like forex, commodities and spot metals.

Cfd trading offers investors and traders the chance to profit from an asset’s price moves without actually having to own the asset itself. Long cfd trading dan short cfd trading salah satu kelemahan berinvestasi secara tradisional adalah kalian hanya memperoleh profit pada saat pasar sedang naik. When trading in currency pairs, the spread is often clearly marked.

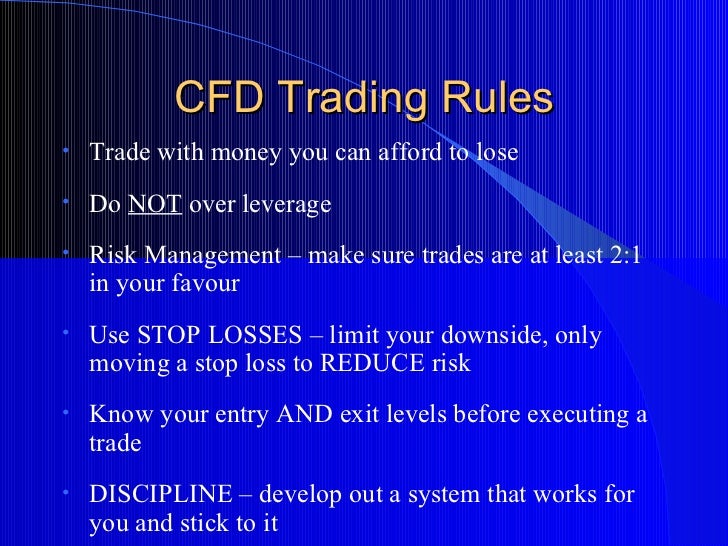

Cfd trading, or otherwise known as ‘contract for difference’ trading is the selling and buying of cfds. Trading incurs a high level of risk and can result in the loss of all your capital. Cfd trading is a form of derivatives trading.

To offer trading in cryptocurrency derivatives, including bitcoin cfds.

12 CFD trading tips to survive

12 CFD trading tips to survive

CFD Trading Infographic tradingreview.uk

What Is CFD Trading and How Does It Work? one way stock

What Is CFD Trading and How Does It Work? one way stock

Collegue and Forex cfd trading

What is CFD Trading CFDs Explained with Examples City

What is CFD Trading CFDs Explained with Examples City

Trading CFD en ligne Trading forex avis

Trading CFD en ligne Trading forex avis

CFD Trading Review Your Trust Review

CFD Trading Review Your Trust Review

Contracts for Difference What is CFD Trading?

Contracts for Difference What is CFD Trading?

Contracts for Difference What is CFD Trading?

Contracts for Difference What is CFD Trading?

Contracts for Difference What is CFD Trading?

What is CFD Trading CFDs CFD Transaction Singapore

What is CFD Trading CFDs CFD Transaction Singapore

CFD Trader CFD Trading Strategies & Examples City Index UK

CFD Trader CFD Trading Strategies & Examples City Index UK

Forex Trading Leverage Example Forex Gump Ea Review

Forex Trading Leverage Example Forex Gump Ea Review

CFD Trading Examples Examples of CFD Trading CFD

CFD Trading Examples Examples of CFD Trading CFD

What Is CFD Trading and Know Its Benefits? 0Censor

What Is CFD Trading and Know Its Benefits? 0Censor

CFD Meaning What You Need To Know?

CFD Meaning What You Need To Know?

What is CFD Trading CFDs Explained with Examples City

What is CFD Trading CFDs Explained with Examples City

What is CFD trading? Introduction to Contracts for Difference

What is CFD trading? Introduction to Contracts for Difference

CFD Trading definition, what is online CFD Trading

CFD Trading definition, what is online CFD Trading

0 Comments